It was revealed last month that Samsung's NAND flash memory sales had hit an all-time high during the January-March period, and it's now looking like the firm is hoping to encourage this number to grow throughout the remaining half of the year in order to widen the gap between itself and its competition.

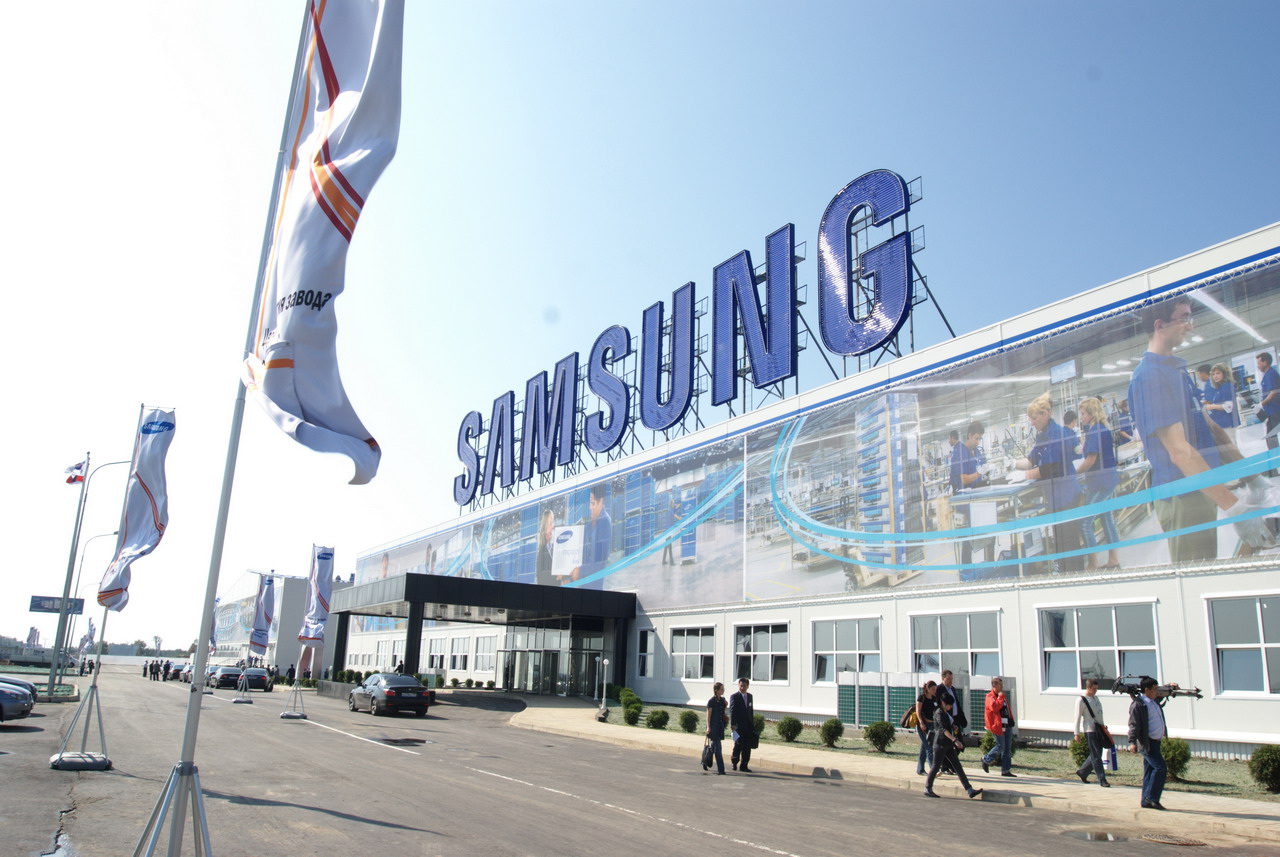

Market researcher IC Insights believes that the Samsung will raise capital spending by an eye-watering 120 percent, which roughly equates to $7.5 billion. This money is expected to be invested into new facilities to expand production lines for vertical NAND memory chips and non-memory chips for smartphone applications.

To prevent itself from dipping into profits, Samsung will need to cut capital spending for another of its industries, and IC Insights predicts this will be its declining semiconductor business. It anticipates that funding will be reduced by as much as 15 percent, leaving the industry bosses with around $15 million to invest in development strategies.