Samsung Electronics' revenue was KRW 70.46 trillion (around $57.21 billion) in the quarter ending December 31, 2022, which is an 8% drop compared to Q4 2021. The company's operating profit was KRW 4.31 trillion (around $3.5 billion), which is a 69% drop compared to Q4 2021. The company's annual revenue for 2022 was KRW 302.23 trillion (around $245 billion), which was its highest, but its full-year profit was just KRW 43.38 trillion (around $35.22 billion).

“The business environment deteriorated significantly in the fourth quarter due to weak demand amid a global economic slowdown. Earnings at the Memory Business decreased sharply as prices fell and customers continued to adjust inventory,” said the company in its earnings report.

Samsung's semiconductor division barely broke even in Q4 2022 due to low memory chip prices and demand

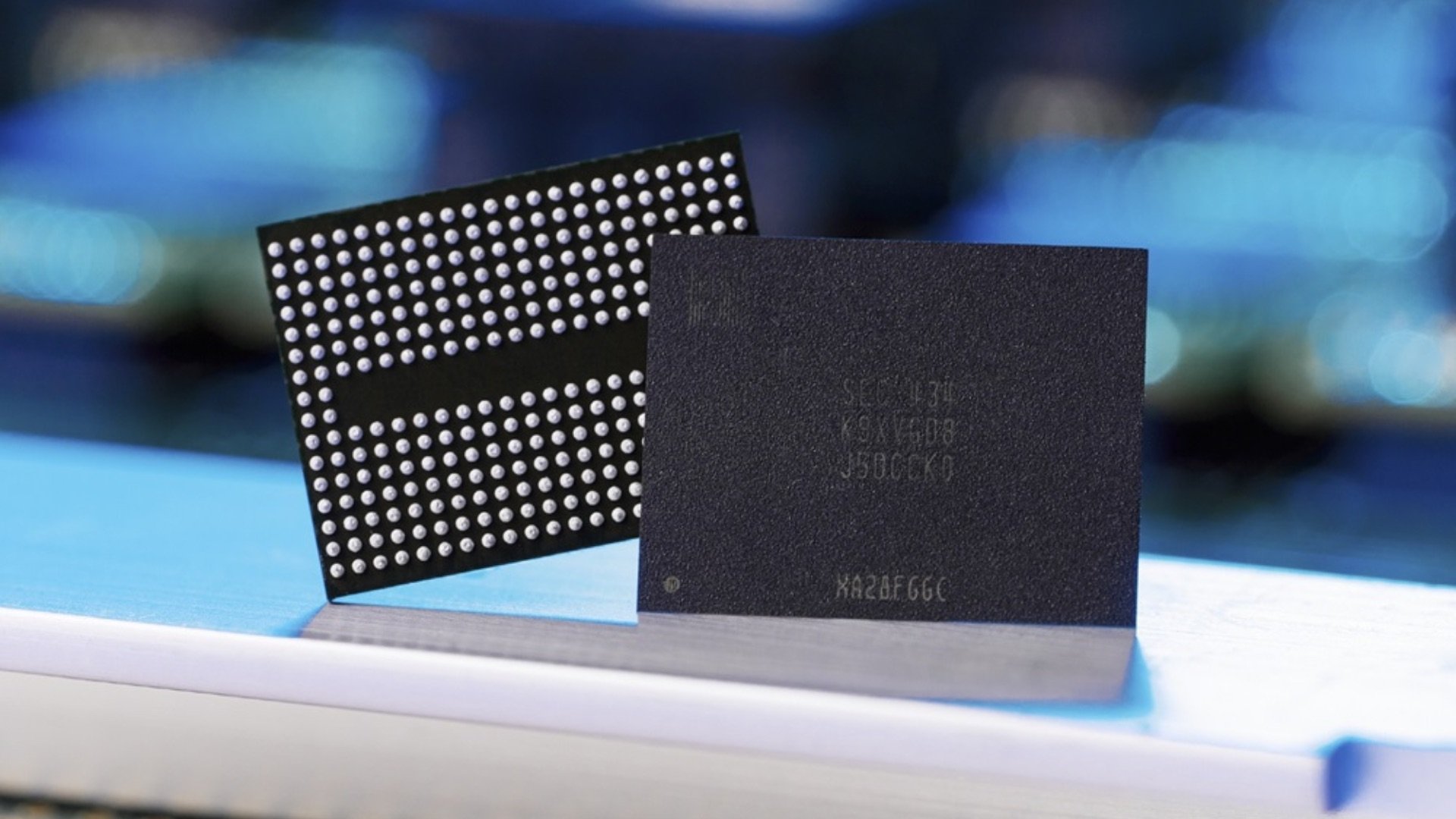

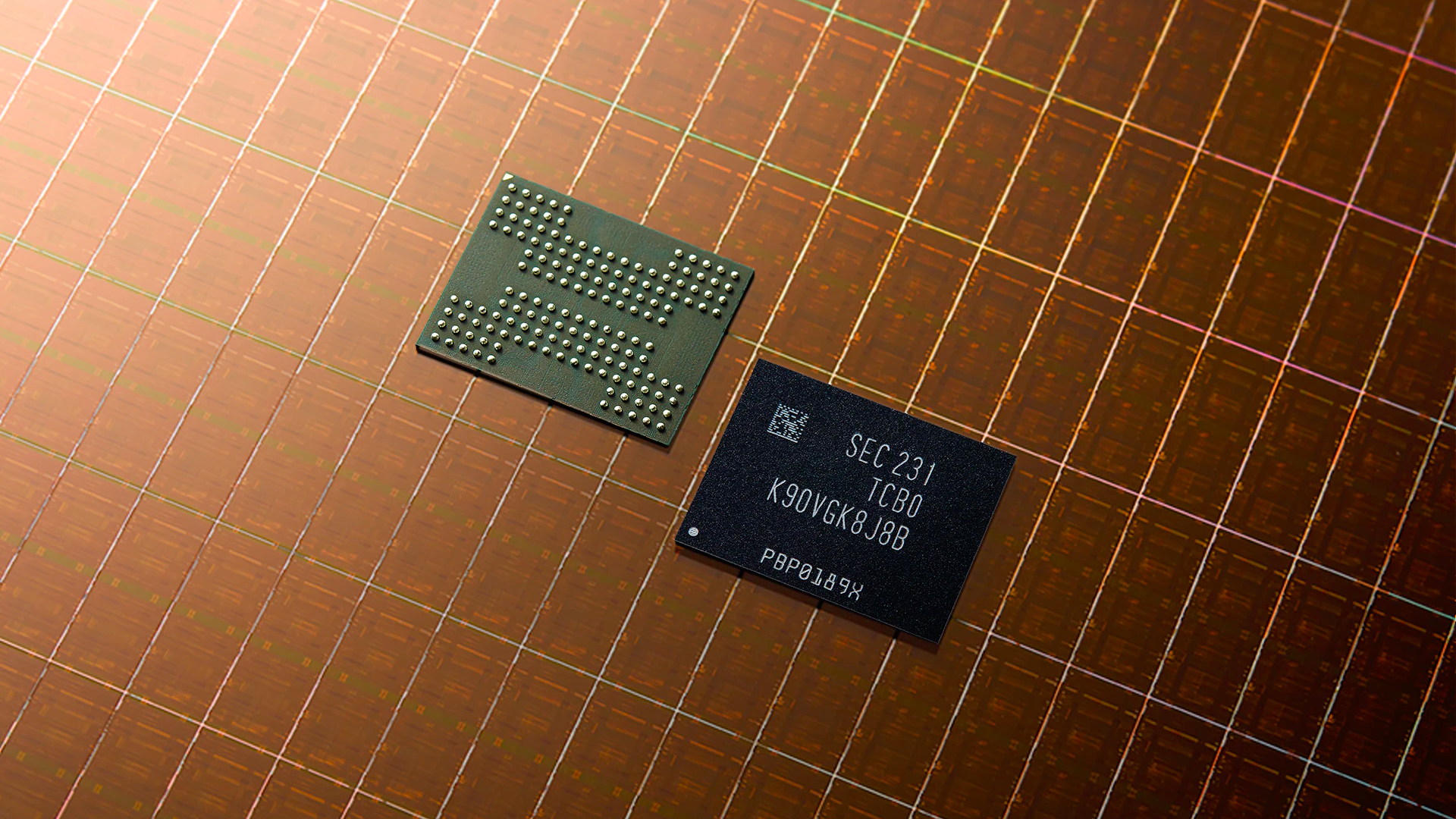

Samsung's chip division, Samsung DS, which usually contributes the most to the company's income, had a disappointing quarter. During the COVID-19 pandemic, the company sold record-breaking semiconductor chips like DRAM and NAND storage. These chips are used in smartphones, tablets, laptops, PCs, gaming consoles, wearables, TVs, and even servers. However, due to high inflation, rising interest rates, the ongoing economic recession, and geopolitical tensions, the demand for these consumer electronic devices dropped sharply. Enterprises started cutting costs, resulting in lower chip sales and low chip prices. Hence, Samsung DS' Q4 2022 operating income was just KRW 270 billion (around $219 million), which is considered barely breaking even in the semiconductor business.

System LSI, which makes camera sensors, smartphone processors, and automobile processors, had a poor run as the sales of major components decreased. Its automotive chip sales improved as the company gained a major European carmaker and signed an MoU (Memorandum of Understanding) for product development with an autonomous driving solution company in the US.

Samsung Foundry, Samsung's chip manufacturing division, did well as advanced semiconductor chip nodes such as 4nm and 5nm had more clients. Its full-year sales reached a record high. The company said that it would strive to gain clients for its second-generation 3nm GAA node and accelerate the development of the 2nm semiconductor chip manufacturing node. Samsung claimed that it hit a stable yield for its 3nm chip manufacturing process.

However, Samsung isn't the only semiconductor chip firm with a forgettable quarter. Its rivals Micron ($195 million loss) and SK Hynix reported losses for Q4 2022.

Demand for smartphones and other consumer electronics dipped due to the global economic downturn and other factors

Samsung DX, which is Samsung's consumer electronics business, also had a poor run in the last quarter of 2022. The consumer electronics division contributed just KRW 1.64 trillion (around $1.33 billion) to the company's profit. The demand for even low-end and mid-range phones dipped, and Samsung faced a lot of heat from Apple in the high-end smartphone segment. Samsung was still among the better performers in the smartphone segment, increasing its market share slightly (compared to 2021), even as Chinese rivals OPPO, Realme, Vivo, and Xiaomi struggled during Q4 2022.

The company confirmed in its press release that it will launch the Galaxy S23 series in the current quarter and will focus on high-end smartphones for higher profits. It also said that the Galaxy S23 series focuses on an enhanced camera, gaming performance, and better integration with other Galaxy ecosystem products like laptops, tablets, and wearables.

The TV business posted higher revenue and profit as the sales of its premium TVs (QD-OLED and Neo QLED) increased. However, the demand for TVs is expected to drop due to the current global economic conditions. It plans to tackle this problem by focusing on increased profitability through its premium TVs, such as its 98-inch Neo QLED TV, and by releasing Micro-LED TVs in various sizes. The company's home appliances division saw a profit decline as the cost increased and competition improved. However, it said that it would continue to focus on its premium appliances, including those in the Bespoke lineup and SmartThings smart home compatibility.

Samsung Networks, the company's telecommunication infrastructure business, performed well as countries worldwide started expanding 5G networks. The networks division will focus on North American and South Korean markets for further improvements in its business.

Samsung Display performed brilliantly in Q4 2022 on the back of the iPhone 14 launch

Unlike Samsung's other business divisions, Samsung Display performed solidly in Q4 2022. It contributed KRW 9.31 trillion (around $7.56 billion) in revenue and KRW 1.82 trillion (around $1.47 billion) in the company's profit. That's primarily due to the launch of Apple's iPhone 14 series in Q4 2022. A majority of those devices use OLED panels made by Samsung Display. Its large panel business, which supplies displays for TVs and monitors, narrowed its losses as the demand for QD-OLED panels picked up.

The South Korean tech giant warned that these business conditions would persist, but it hopes the situation will improve in the second half of 2023. The company expects the demand for high-end smartphones like the Galaxy S and Galaxy Z series to continue, while the demand for low-end and mid-range devices will continue to be low.