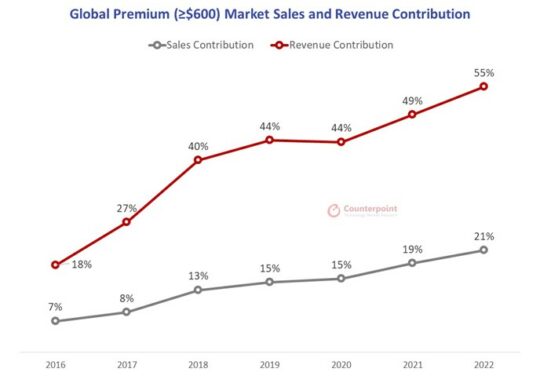

The demand for premium phones is increasing significantly, with Apple leading the way and Samsung coming in at a close second. Counterpoint Research recently released statistics regarding the 2022 premium smartphone market. Interestingly, despite global smartphone sales dipping 12% year-over-year, the premium segment witnessed an increase of 1% in the same period. That brought the share of high-end devices worldwide up to 55%, the highest ever. These results are indicative of the fact that even the top-tier Samsung models will be subject to an escalated price structure, largely led by Apple.

Smartphone brands are selling fewer budget and mid-range phones than they have in the past, while phones in the $1,000 range are experiencing a surge in sales. The logical consequence of this trend is reflected in the current market.

Samsung fails to capitalize on the Chinese Market, study says

Apple saw a 6% year-on-year uptick in sales for the premium smartphone market, capturing three-fourths of total sales in the segment. The iPhone maker benefited from the decreased sales of Huawei in China, with Samsung trailing behind with a 5% decrease in year-over-year (YoY) sales in 2022.

The lack of substantial footprints in China forestalled the full benefit of the commercial opportunity offered by the region for the South Korean electronics giant. Nonetheless, Samsung has seen a lot of interest in its foldable smartphones, capturing a majority of the foldable market in 2022.

To be clear, the title of the chart below includes the notation “(≥$600)”, which pertains to wholesale pricing of phones as opposed to retail. Counterpoint Research accounts for this factor in market analysis to ensure accuracy, as retail pricing tends to vary significantly around the globe.

It is hardly surprising that we are witnessing an increasing number of customers opting for high-end smartphones within the annual cost bracket of up to $1,000. Those who are financially comfortable have not been buffeted by the economic issues of the past few years in the same way as many others. Nevertheless, many are still opting for these high-end phones for several reasons. First, they are thinking ahead, as top-tier phones typically come with better hardware, better software, and longer-lasting support. Additionally, they may be expressing allegiance to a certain brand by paying for a premium model. Ultimately, such devices serve as a fashionable and conspicuous testament to the user.

Despite the cause, the reverberations of this news will be felt throughout the industry. OEMs will focus on developing and promoting high-end products, resulting in fewer mid-range device offerings. Thus consumers can expect to pay more for devices as premium phones are likely to remain a mainstay and command higher prices than in the past.