Yesterday, it was revealed that Samsung was the world's biggest smartphone brand during the third quarter of this year. Now, a new report shows how Samsung fared in the Indian smartphone market, which is among the biggest and most important markets in the world these days.

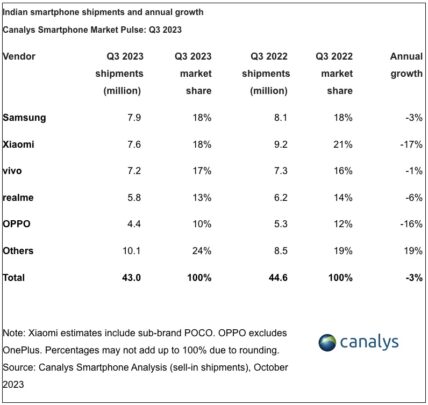

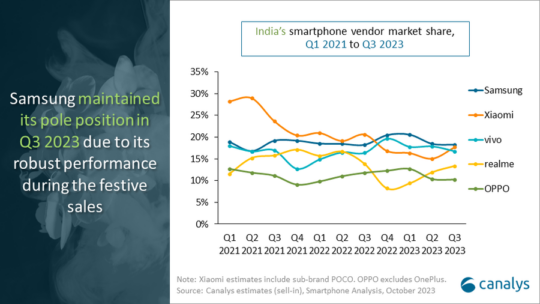

According to a new market analysis report from Canalys, Samsung was the biggest smartphone brand in India, too, but with a narrow margin. The company shipped 7.9 million smartphones in India during Q3 2023, which is 3% lower than similar numbers from Q3 2022. Its market share was 18% during the period, which is similar to its market share last year. While Samsung stayed almost flat, most other smartphone brands saw huge declines in their shipment figures due to uncertain economic conditions and rising inflation.

Xiaomi ranked second with 7.6 million smartphone shipments and 18% market share, 17% lower than its shipments from last year. Vivo stayed almost flat after shipping 7.2 million smartphones and capturing a market share of 17%, just 1% lower than the 7.3 million shipment figures from Q3 2022. Realme ranked fourth, with its shipment figures hovering around 5.8 million units and market share at 13%. That's 6% lower shipment figures compared to last year.

OPPO saw a huge decline in shipments, too, at 4.4 million and a market share of 10%. That's 16% lower than 5.3 million smartphones shipped in Q3 2022. Overall, the Indian smartphone market dropped by 3%, and Samsung seems to be in line with it. Most other smartphone brands saw a major decline in their businesses.

Canalys analyst Chaurasia said, “The growth in 2024 hinges on uncertain macroeconomic factors, particularly affecting the vulnerable entry-level segment. However, the Indian economy remains relatively resilient to sudden shocks from these variables, and brands are adapting to market dynamics. To maintain market share, vendors should prioritize reducing channel pressures and building a lean product portfolio. They should have ‘hero models’ in each price segment while maintaining balanced inventories across channels.”