After posting its earnings estimates for Q4 2023 a few weeks ago, Samsung has now published its final earnings for the fourth quarter of last year. While the company's condition has improved slightly compared to the earlier quarters, it is far from the glory days that it saw after the COVID-19 pandemic.

Samsung's revenue and profit improved slightly in Q4 2023, but it was still lower than last year

Samsung Electronics has announced that its revenue for Q4 2023 was KRW 67.78 trillion ($50.78 billion), and its operating profit for the quarter was KRW 2.82 trillion ($2.11 billion). The company's annual revenue last year turned out to be KRW 258.94 trillion ($194.01 billion), while its operating profit was just KRW 6.57 trillion ($4.92 billion). The company said that its revenue and profit increased in the fourth quarter compared to the third quarter. However, when you look at the year earlier, its profit declined 34.4% from KRW 4.3 trillion ($3.22 billion).

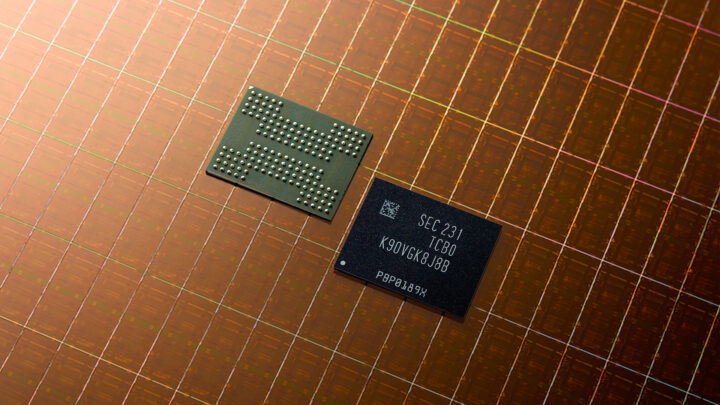

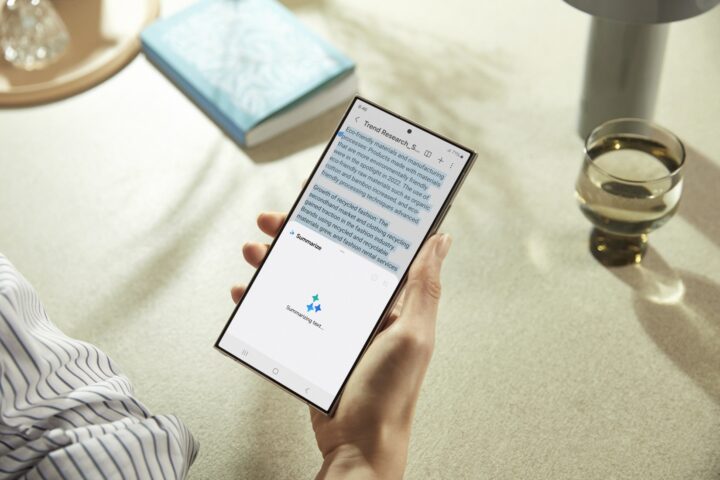

Most of the improvement in revenue and profit is owed to increased semiconductor memory chip prices and sales of premium display panels. The company expects things to improve further in Q1 2024, as it is planning to improve the sales of higher-end products, including the recently launched Galaxy S24 series. The company is banking on the booming AI and Generative AI market, and it plans to sell more semiconductor chips that are used for AI processing in the cloud and on-device and by integrating AI-powered features in its smartphones, TVs, and appliances.

Samsung expects things to improve significantly in the second half of 2024

Samsung said that economic uncertainties will remain in 2024. If you don't know already, the global economic condition still hasn't improved, and several companies are laying off their employees in large numbers. So, people might not spend money on products like expensive home appliances, smartphones, and TVs. However, the South Korean firm said that its financial performance will improve slightly in the first half of 2024, and a more significant improvement will be seen in the second half of this year.

The company spent billions of dollars last year in building its memory chip manufacturing infrastructure at its facility in Pyeongtaek, South Korea. It also invested capital to improve the production capacity of HBM, DDR5, and other advanced semiconductor chips. It also made significant investments in improving its 5nm or better semiconductor chip fabrication processes and production capacity. In the display panel segment, its investments were mainly related to OLED panel production for laptops and monitors and flexible displays for mobile products.