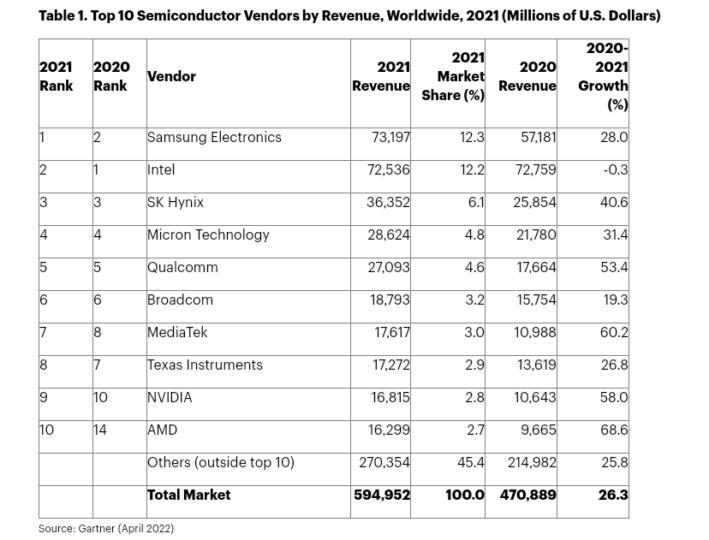

Last year, after lagging behind Intel for a few years, Samsung's semiconductor business finally recorded higher revenues than its US rival. Samsung's semiconductor revenues overtook Intel's for the first time since 2018.

The Korean tech giant had a 12.3% semiconductor market share and recorded $73.1 billion in revenue in 2021 (via Gartner). Intel dropped to 2nd place with 12.2% and $72.5 billion in revenue.

SK Hynix took 3rd place in 2021 with a share of 6.1% in the semiconductor market. Qualcomm was 5th with 4.6%, MediaTek was 7th (3%), Nvidia climbed to 9th place with 2.8%, and AMD also gained four spots to enter the top 10 semiconductor giants with 2.7% market share.

According to the report, DRAM sales accounted for 27.9% of all semiconductor sales last year. Revenues were up 33.2%.

Other market segments also grew in 2021 compared to 2020, contributing to a higher semiconductor demand. The wireless communications market, which includes smartphones, increased by 24.6%. The automotive segment outperformed all others with 34.9% YoY growth.

China loses semiconductor revenue while South Korea tops the charts

Per country, South Korea recorded the highest growth in the global semiconductor market with a 19.3% share, thanks to memory sales.

China's global semiconductor share declined from 6.7% in 2020 to 6.5% in 2021. Huawei's semiconductor company ‘HiSilicon' experienced a massive drop of 81% in revenue, from $8.2 billion to $1.5 billion over one year.

Analysts attribute HiSilicon's massive losses to its parent company, Huawei, and the heavy sanctions imposed by the United States government.

Join SamMobile’s Telegram group and subscribe to our YouTube channel to get instant news updates and in-depth reviews of Samsung devices. You can also subscribe to get updates from us on Google News and follow us on Twitter.