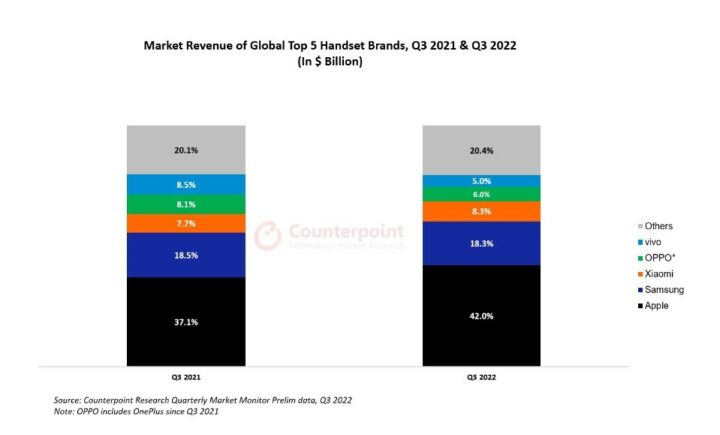

It has been a pretty rough year for the technology sector, especially the smartphone market. Factors such as massive layoffs and economic downturns in several regions of the world have pushed people to stick with their current phones instead of buying new ones. Well, the impact of this can be seen in the global handset revenue numbers for Q3 2022.

According to Counterpoint Market Research, the global smartphone revenue in Q3 2022 went down by 3% YoY (year-on-year), while the smartphone market also saw a 12% YoY dip in handset shipments for the quarter. The decline could have been worse, but it was avoided thanks to Apple's iPhone 14 series, which saw 10% YoY revenue growth and 7% average selling price (ASP) growth in Q3 2022. Apple's growth contributed to the overall increase in the global handset ASP.

Apple's competitor and the second-biggest smartphone brand in terms of revenue, Samsung, saw a 4% YoY revenue decline in Q3 2022. However, it managed a modest ASP increase of 2% YoY in Q3 2022, despite doubling the shipments of the Galaxy Z Flip and the Galaxy Z Fold series and attaining 27% YoY growth of its 5G smartphones. As noted by the Counterpoint Research report, the decline in ASP could be the result of the company's shift towards the more successful S22 series and the upcoming foldable smartphones in 2023.

As for Chinese brands, OPPO witnessed an ASP decline of 5% YoY in Q3 2022 and a revenue decline of 27% YoY. Xiaomi, on the other hand, managed to increase its revenue by 4% YoY, thanks to its low and mid-tier phones. 5G smartphones' revenue reached an all-time high of $80 billion, which is 80% of the global handset revenue. LTE handsets' revenue declined by 10% to $19 billion. Overall, Apple led the transition from 4G to 5G, with over 95% of its phones supporting 5G.