NVIDIA's GTC tech conference was closely watched this week as the world's leading supplier of AI accelerators was set to unveil its next-generation products. Rubin Ultra, the successor to its Blackwell series, was confirmed to arrive in the second half of 2027, featuring HBM4e memory.

SK Hynix has been responsible for supplying the bulk of HBM3E memory to NVIDIA, while Samsung's high-bandwidth memory has still been unable to win approval from the chip giant. On the other hand, SK Hynix took the opportunity to showcase a prototype of its next-generation HBM4 modules at GTC this week.

SK Hynix shows off next-gen HBM4 memory at GTC 2025

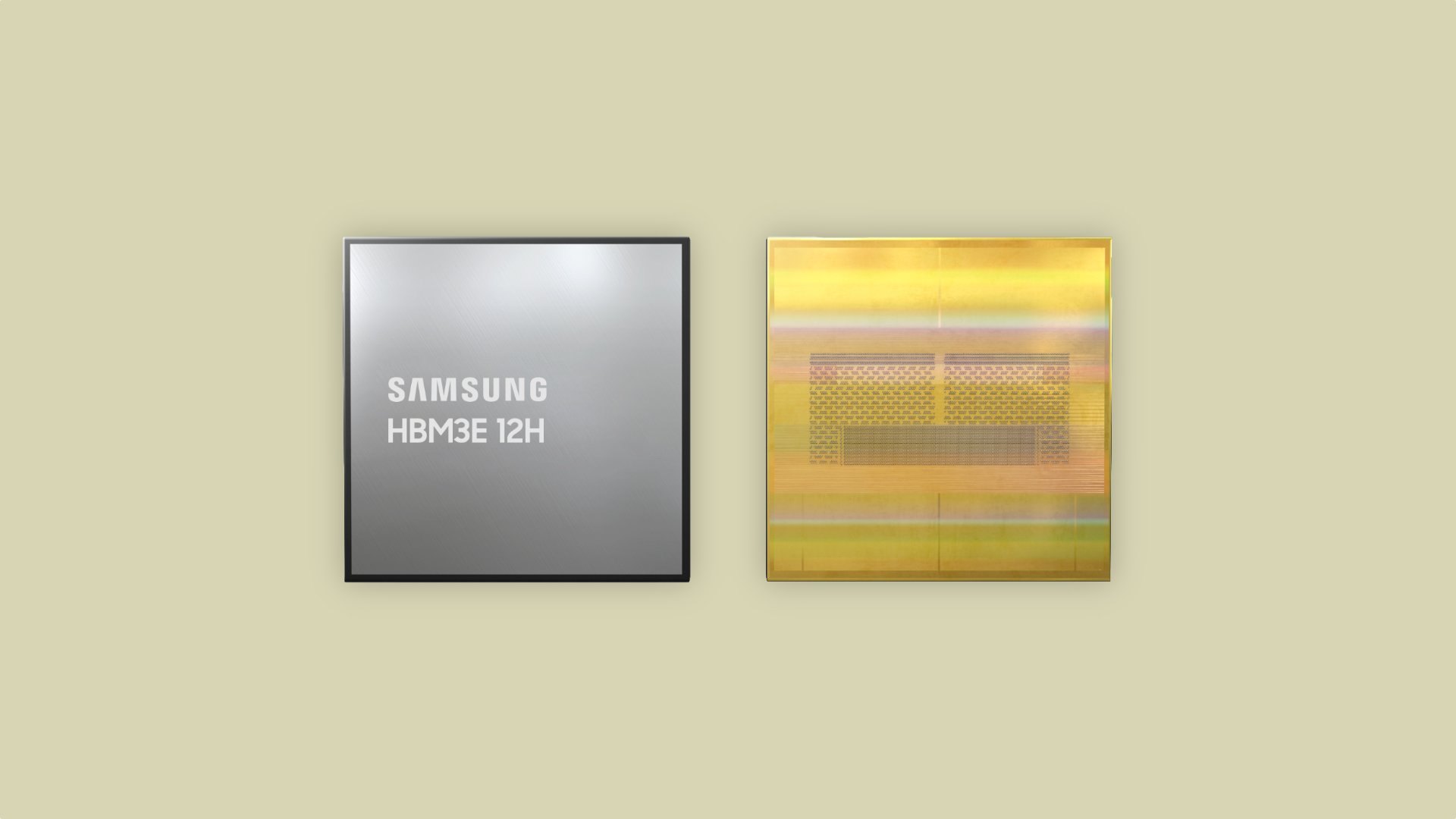

It was reported a couple of months ago that Samsung had shifted focus to HBM4 chips as SK Hynix had essentially run away with the order book for the current-generation modules. Samsung wanted to ensure that there wouldn't be a repeat of the challenges that it has suffered with HBM3 as NVIDIA and other AI chip designers introduce next-generation produces in the coming years.

As it stands, Samsung has internally set a goal to complete the Production Readiness Approval procedure for HBM4 chips in the first half of 2025. This is six months ahead of schedule as Samsung was previously planning to achieve this approval by the end of this year.

Meanwhile, SK Hynix made its presence felt at GTC 2025 as it showed off its 12-layer HBM3E, which is currently the most advanced high-bandwidth memory in production. Meanwhile, SK Hynix made its presence felt at GTC 2025 as it showed off its 12-layer HBM3E, which is currently the most advanced high-bandwidth memory in production. SK Hynix is hoping to begin mass production of its HBM4 chips in the second half of this year.

It's largely been a year to forget for Samsung. Despite receiving a “Jensen-approved” autograph from the NVIDIA CEO Jensen Huang at GTC 2024, its HBM3E modules have been unable to enter the company's supply chain, potentially costing Samsung billions in lost revenue. SK Hynix continues to flex its might in the industry, sending a clear signal to Samsung that it's ready to repeat with HBM4 what it did with HBM3.