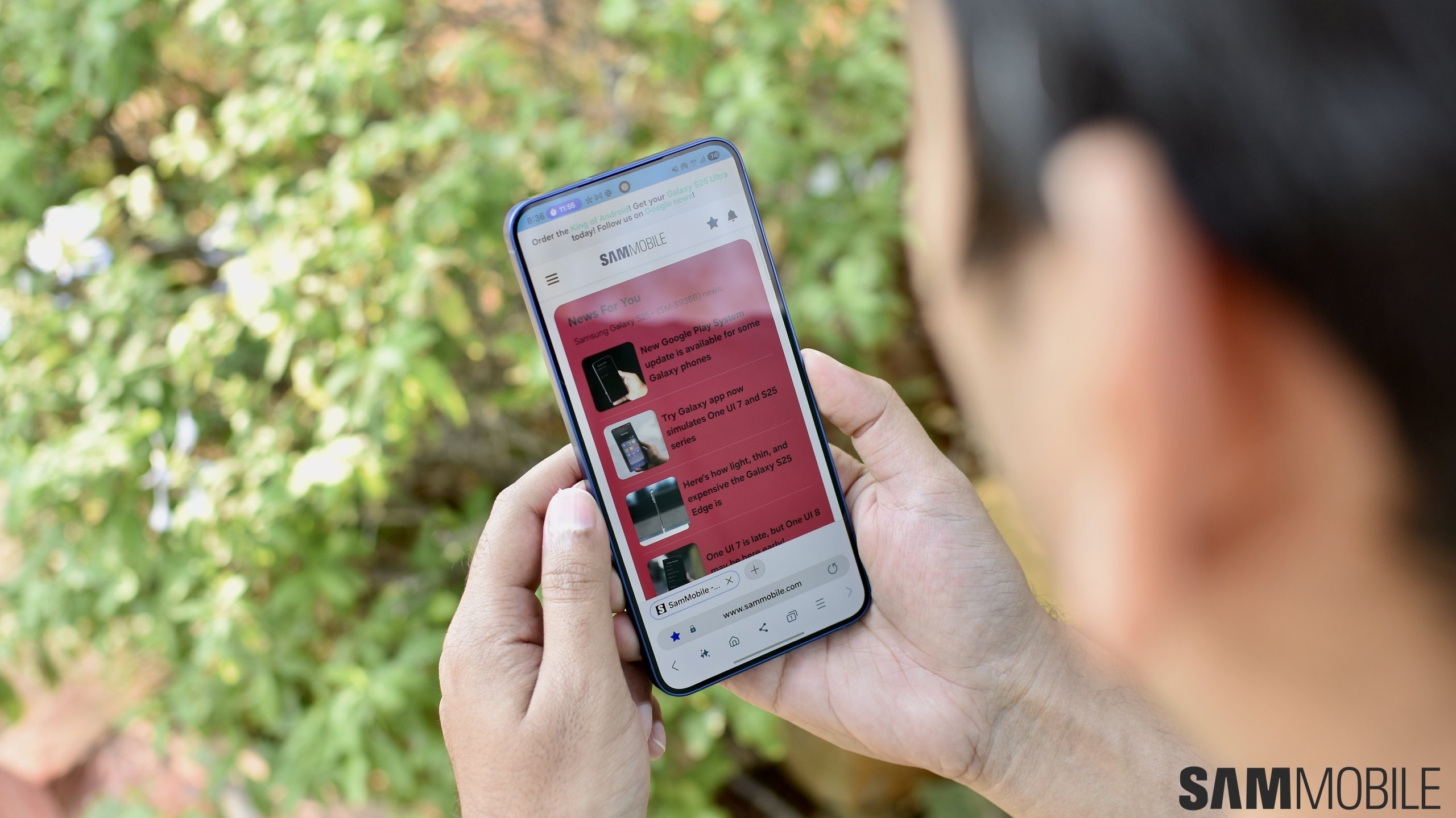

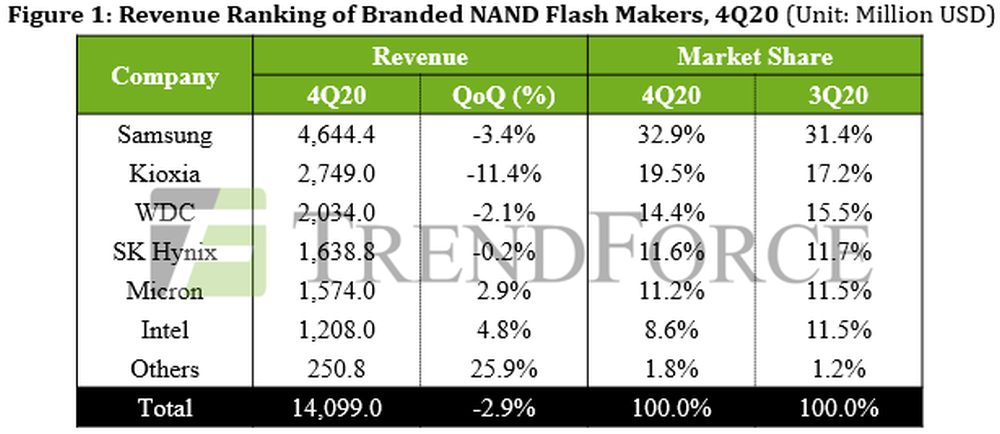

Samsung's NAND business was helped by Chinese OEMs and the PC market

Even though the global NAND market fell a few by nearly 3% in Q4 2020, Samsung was able to increase its market share because of a couple of factors, says the research firm.

Samsung's clients from China, with the exception of Huawei, have reportedly increased their component inventories in an attempt to increase their mobile market share. Meanwhile, PC OEMs had to keep up with an unexpected increase in demand for notebooks.

These factors led to higher NAND sales for Samsung throughout the fourth quarter. The company's NAND flash shipments rose by 7-9% Quarter-on-Quarter, however, this also had an effect on prices. The market trend has caused an oversupply and Samsung was forced to adjust, i.e., lower its prices. As a result, the company experienced a 3.4% QoQ revenue decline.

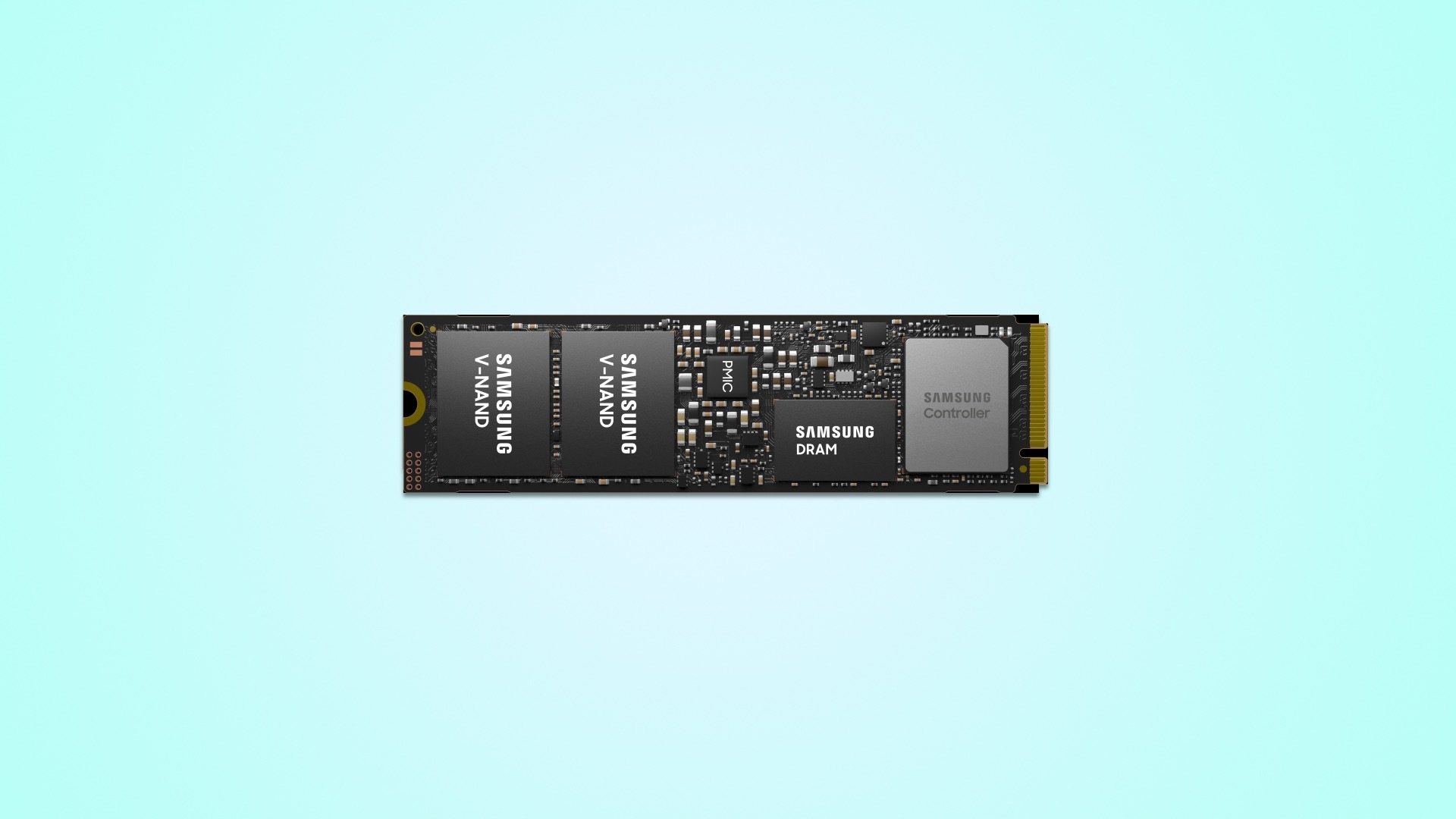

This year, market watchers expect Samsung to continue leading the NAND market as the company increases the production capacity of its V6 process for SSDs and UFS solutions.

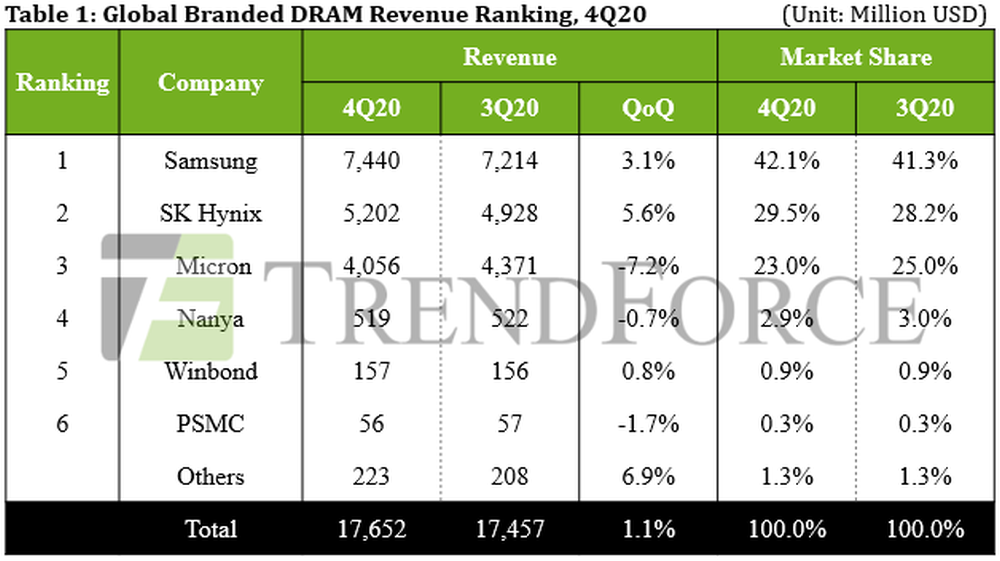

Samsung increases DRAM market share and revenue

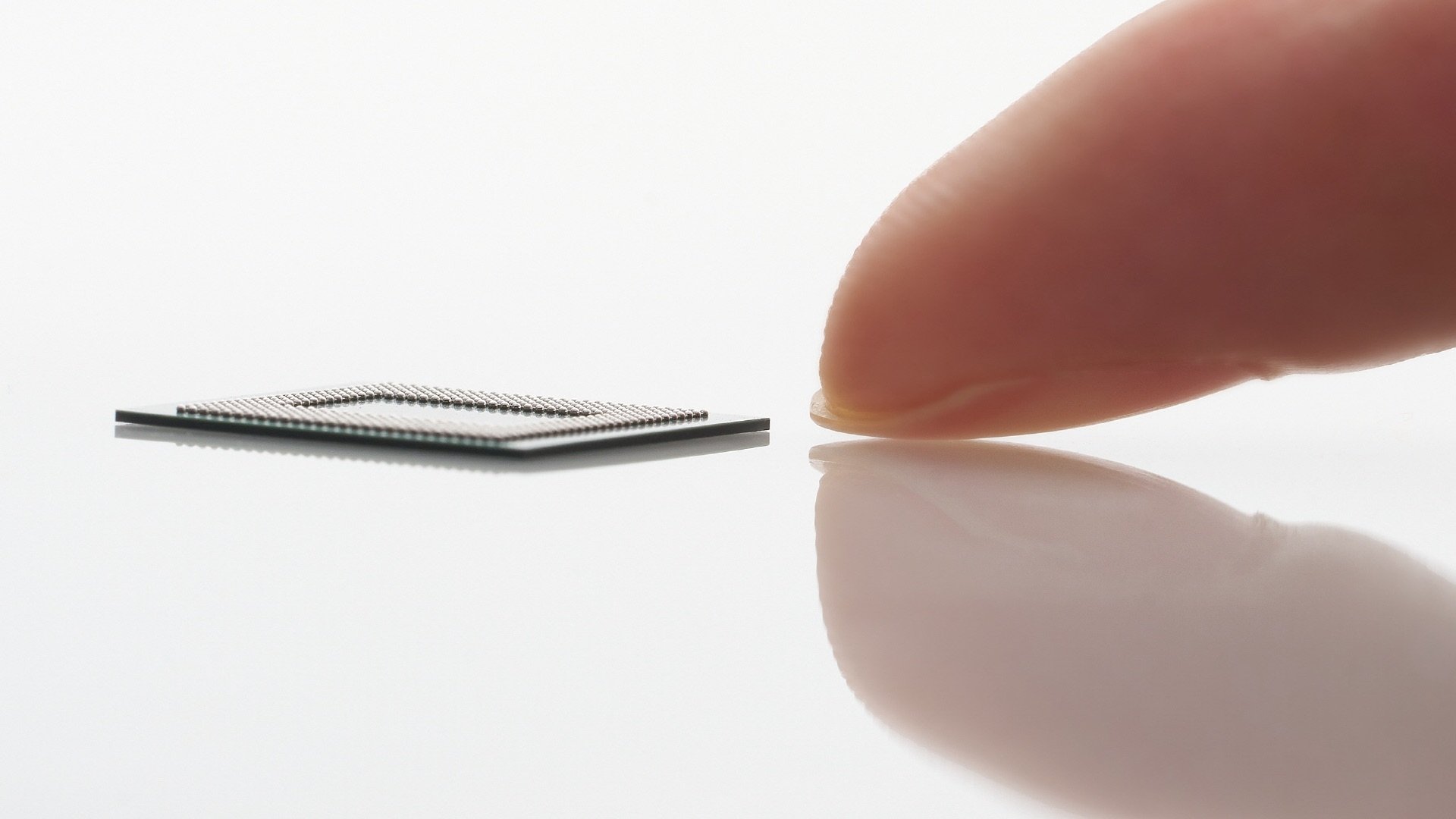

In contrast with the performance of the NAND segment throughout Q4 2020, global DRAM revenues were up 1.1% Quarter-on-Quarter. Samsung recorded a 3.1% revenue increase and its operating profit margins fell to 36% from 41% in the previous quarter.

DRAM quotes have declined in Q4 but Samsung was able to retain at least a 30% profit margin. The company has reportedly offset the downward pressure on revenue by increasing DRAM shipments.

The research firm expects DRAM quotes to rebound from rock bottom in Q1 2021 and kickstart the cyclical upturn in DRAM prices.