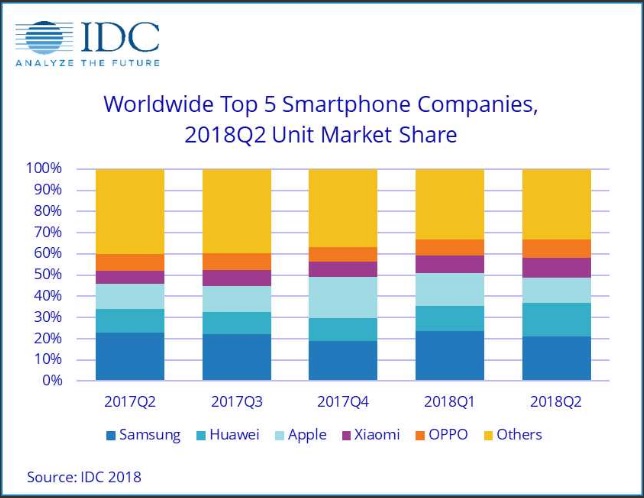

According to IDC, the global smartphone market in Q2 2018 declined 1.8% annually to 342 million units. Samsung suffered a 10.4% YoY drop in the quarter but still emerged as the largest vendor with a 20.9% market share and 71.5 million units shipped. Huawei replaced Apple as the second largest vendor by shipping 54.2 million units and capturing 15.8% market share. Apple, Xiaomi, and Oppo secured the next three spots, respectively.

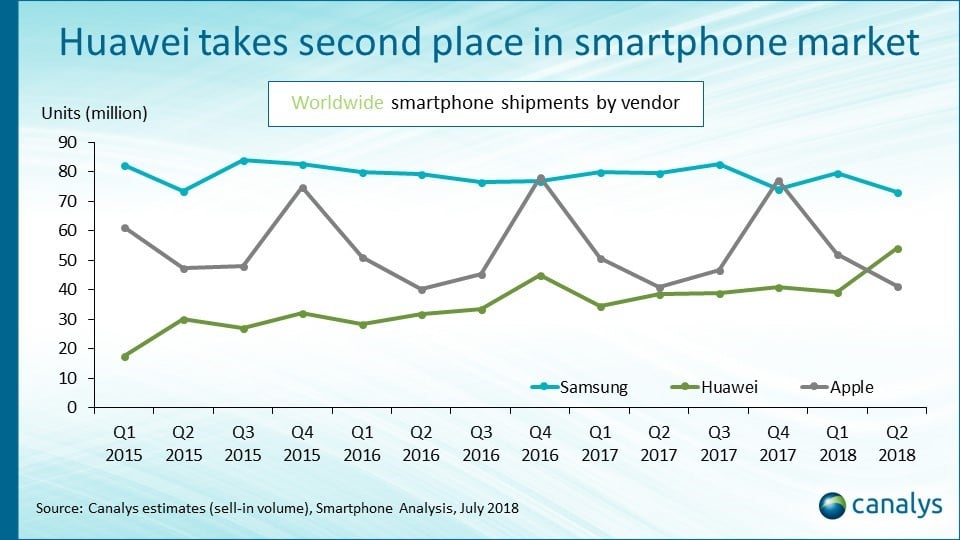

All reports point to a great quarter for Huawei

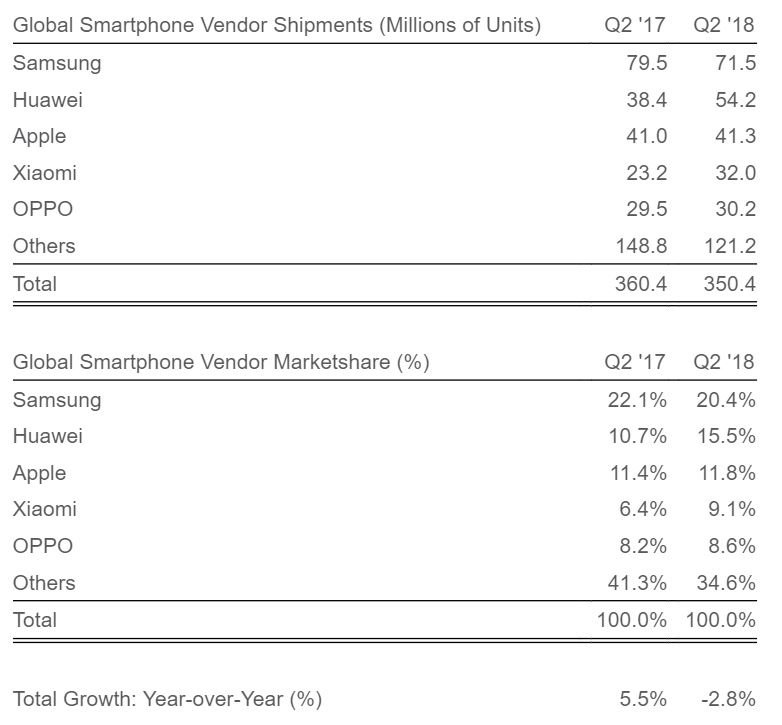

The data from Strategy Analytics is not much different. It says the global smartphone shipments dropped 2.8% YoY from 360.4 million units to 350.4 million in the second quarter. Samsung retained the top spot in the vendors' list, but its shipments fell from 79.5 million units in Q2 last year to 71.5 million units in the same quarter this year. Strategy Analytics also placed Huawei ahead of Apple with similar shipment and market share numbers.

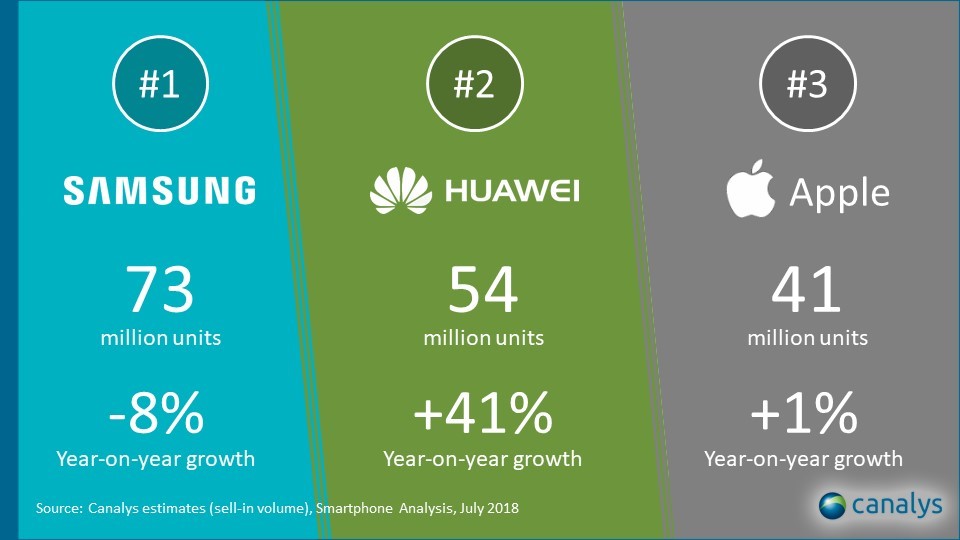

The press release from Canalys mentions only the top three vendors and the rankings are identical to the above reports. The data shows Samsung’s shipments declined 8% annually to 73 million units in Q2 2018, but that was again enough for the company to lead the pack. Huawei grew 41% annually by shipping 54 million units, and Apple grew by a negligible 1% YoY.

Despite the minor differences in data, all the three reports communicate the same thing – that the global smartphone declined around 2-3%, Huawei grew rapidly and overtook Apple, and Samsung is seated at the top even though its shipments dropped. The reports also agree that market saturation and longer replacement cycles are causing the decline in the global smartphone market.