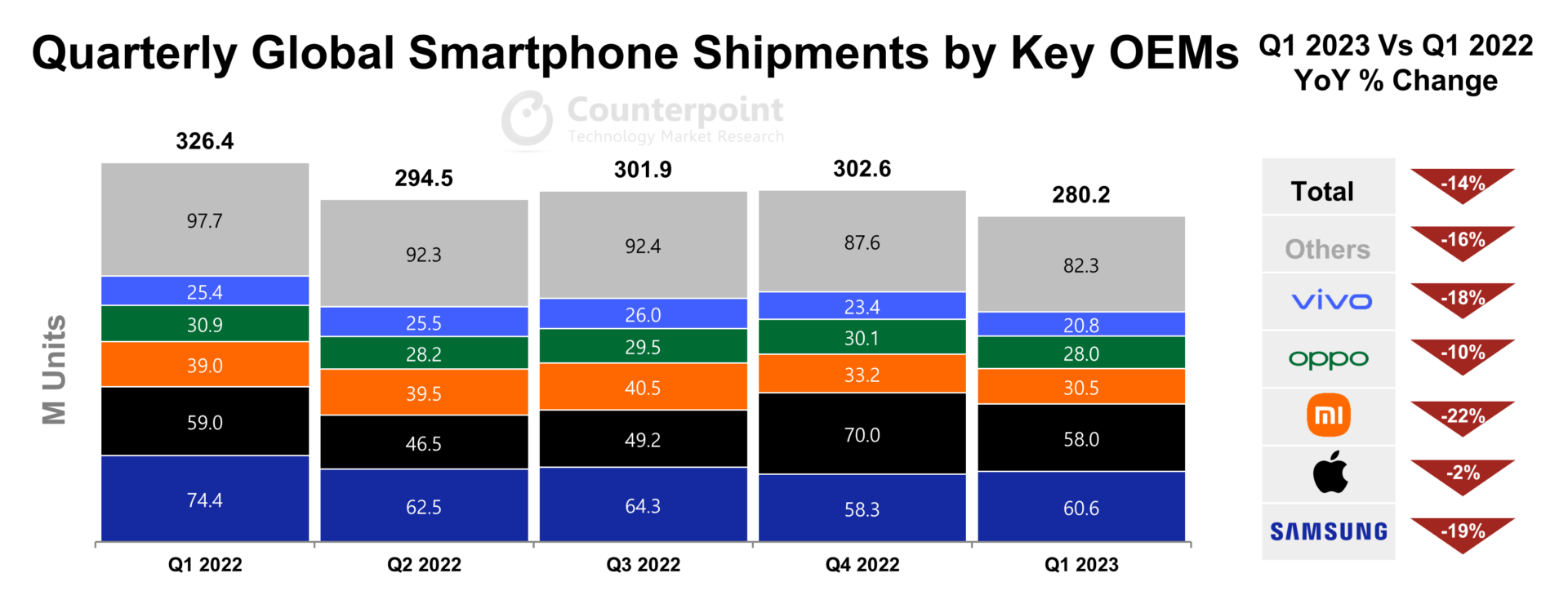

In the first quarter of the year, the smartphone market declined 14% year-on-year and 7% quarter-on-quarter. All OEMs combined shipped a total of 280 million smartphones in the first three months of the year, shows Counterpoint Research.

Samsung recorded the highest shipment figure of 60.6 million units, followed by Apple with 58 million and Oppo with 30.5 million. However, every OEM experienced a year-on-year decline. Samsung's shipments declined 19% compared to Q1 2022, while Apple's and Xiaomi's dropped 2% and 22%, respectively.

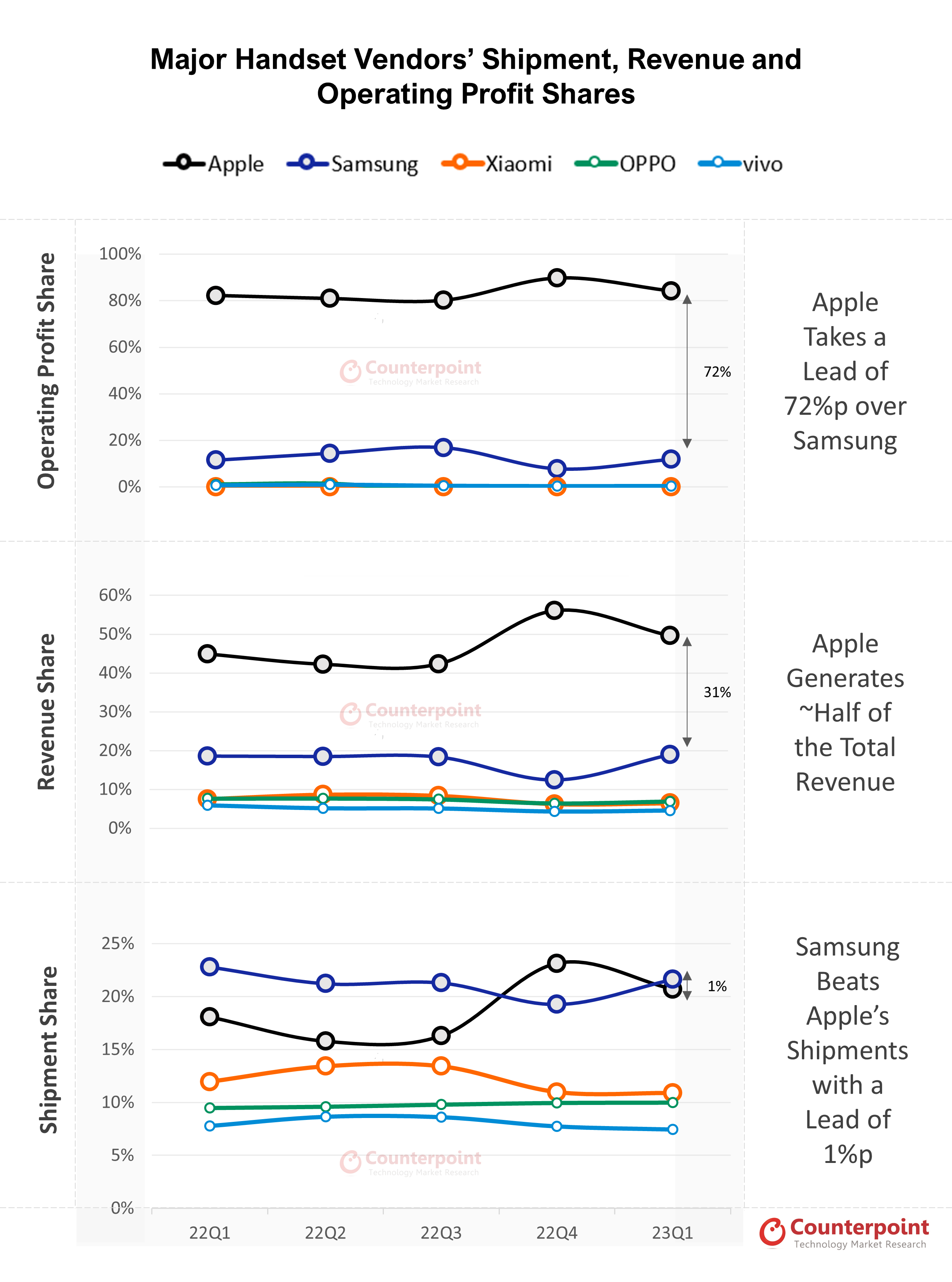

Apple had the highest revenue share and a 31% lead over Samsung

Shipment-wise, Samsung beat Apple by 1% and regained the lead in Q1 after losing it to Apple in Q4 2022. However, Apple had the highest operating profit share by far, with a gap of 72% between it and Samsung.

Similarly, Apple generated half of the total revenue of all smartphone brands combined. The company reached a 50% revenue share in Q1 2022, while Samsung had a 19% revenue share in the same quarter.

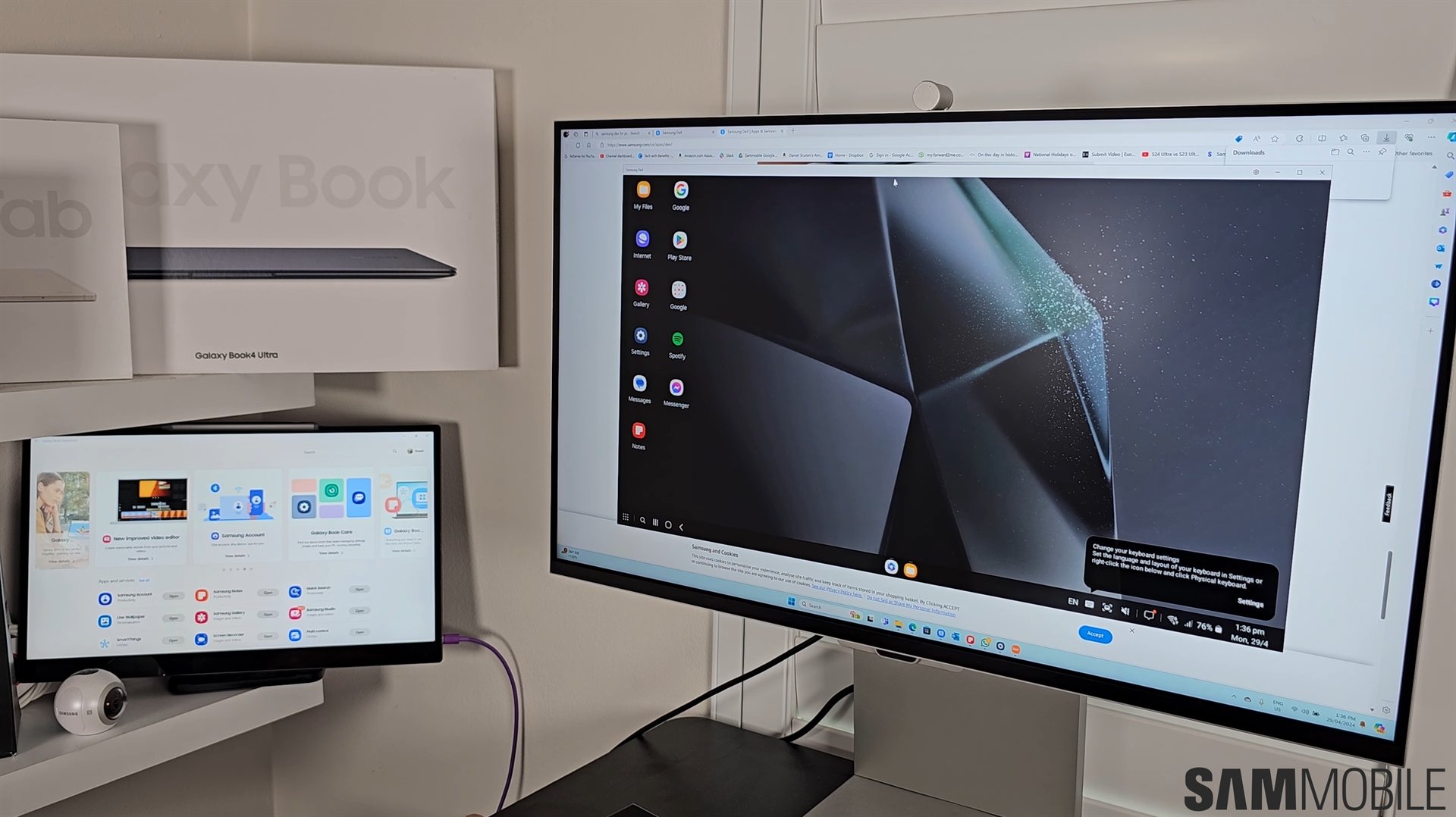

Market watchers say that Samsung's global revenues in Q1 fell less because the launch of the Galaxy S23 series enabled the company to increase its average selling price by 17% year-on-year and 35% quarter-on-quarter.

Analysts say Apple performed as well as it did because of a couple of factors. One is “the stickiness of its ecosystem,” and another is that the brand attracts Gen Z consumers and people willing to spend more on devices they can use for a longer period of time.