Last week, Samsung announced its Q1 2023 earnings, and according to the financial report, the company’s operating profit has dropped by 95% compared to Q1 2022. Samsung says that the decline in demand for memory chips was one of the major reasons contributing to poor financial results, and hinted that the company would decrease the production of memory modules to ease inventory issues. However, Samsung hadn’t revealed how much production it planned to axe. Well, analysts predict it to be around 25%.

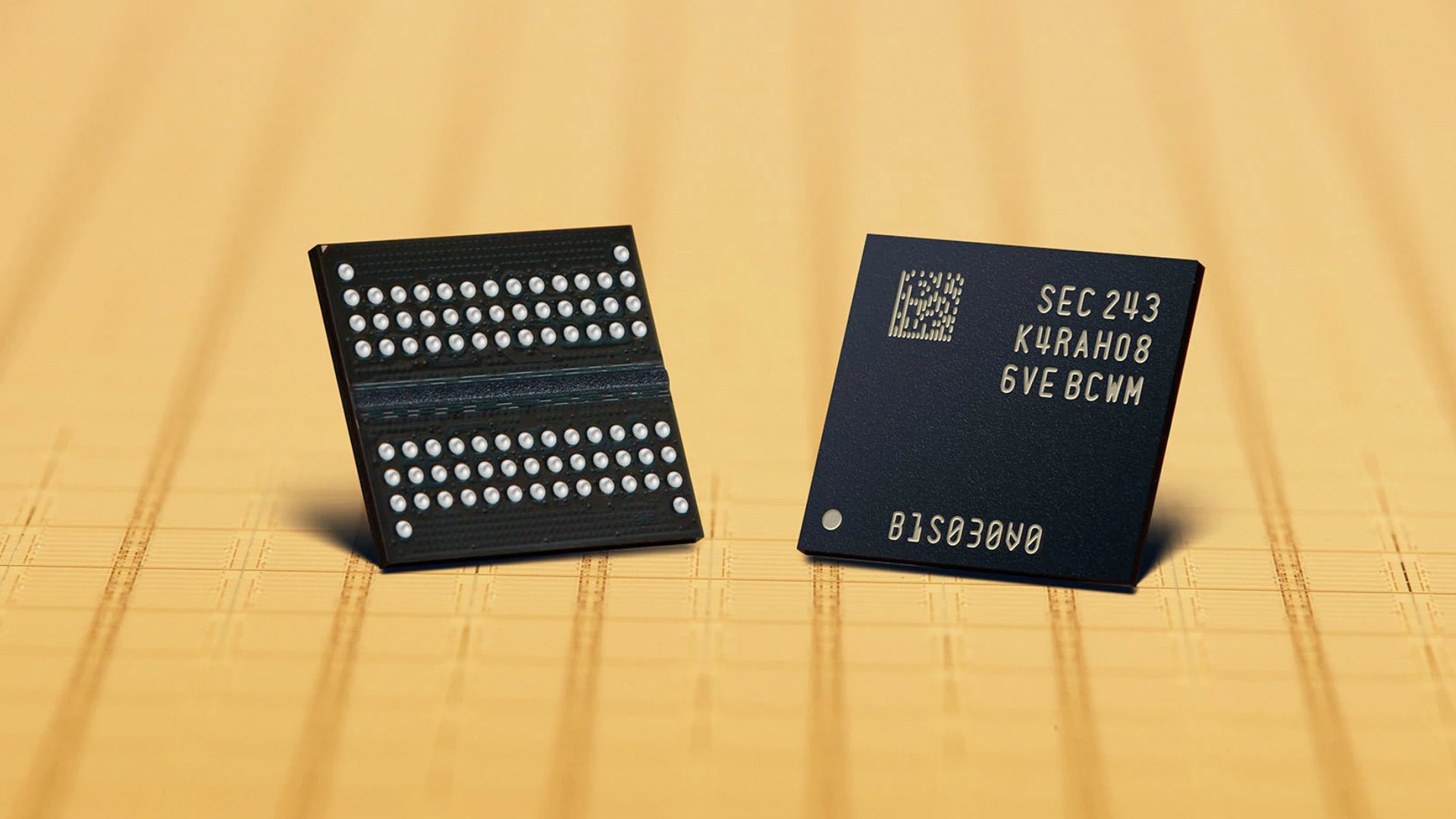

Minbok Wi, Semiconductor Analyst at Daishin Securities, predicts that Samsung could decrease the production of memory chips between 20% to 25% in H1 2023 compared to H1 2022. KB Securities estimates that Samsung would cut the production of NAND flash chips by 15% and that of DRAM chips by more than 20% starting Q3 2023 compared to Q3 2022. Min Seong Hwang, Analyst at Samsung Securities, says that Samsung could decrease production even further if the inventory levels don’t drop sufficiently.

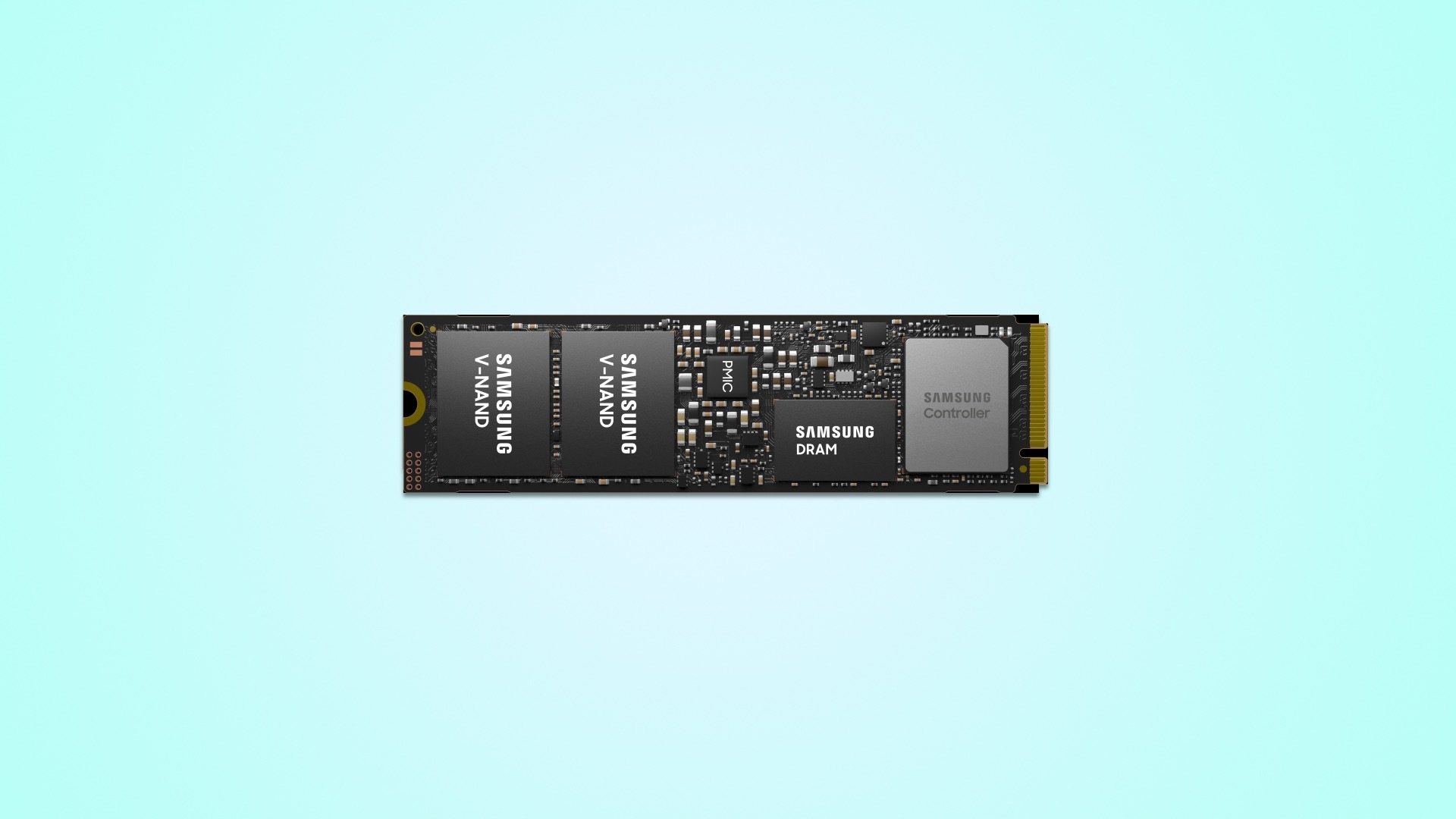

Samsung to cut DDR3, DDR4 production, focus more on DDR5

In the earning call, Samsung revealed that it has enough inventory of memory chips to meet mid to long-term demand and that it is planning to cut the production of legacy products. However, the company hadn’t specified the types of memory chips whose production it planned to reduce. According to The Korea Herald, Samsung is cutting down the production of low-cost DRAM modules, such as DDR3 and DDR4, due to their decreasing demand, and focusing more on advanced memory chips like DDR5, which are gaining more popularity.

On Friday, the average contract price of 8GB DDR4 RAM was recorded at $1.45, which is a 19.9% drop compared to last month. In January too, the prices had dropped by 18.1%. While the market remained stable in February and March, it has started to fall again, in spite of Samsung announcing a production cut. According to TrendForce, prices will plunge 15% to 20% in Q2 2023 as suppliers struggle with high inventory levels. Although there's no sign of relief for Samsung, analysts predict that the chip industry could turn around in 2024.